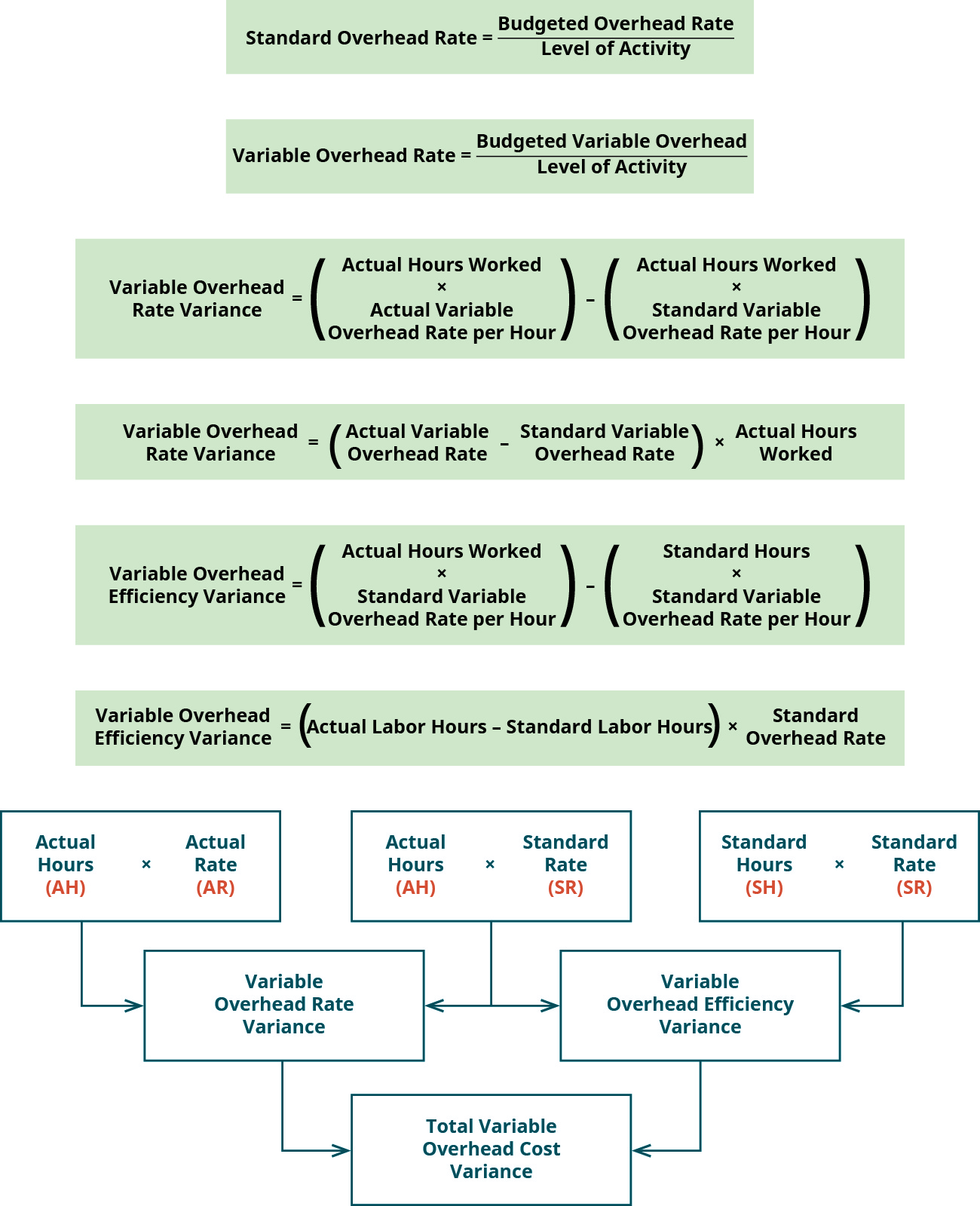

The Usage Variances Focus on the Difference Between

Actual quantity used and standard quantity allowed for actual production. Actual quantity used and standard quantity allowed for budgeted production.

Cost1 10 Final Acn Bs Accountancy Afar001 Plm Studocu

Efficiency variances focus on the difference between a.

. The usage variances focus on the difference between aactual costs of inputs and standard costs of inputs. Actual price and standard price for actual quantity allowed for units actually produced. Actual quantity used and standard quantity allowed for budgeted production.

For example the standard number of ounces of titanium. Actual costs of inputs and standard costs of inputs. A usage variance shows the cost difference between the quantity of actual input and the quantity of standard input allowed for the actual output of the period.

Actual quantity used and standard quantity allowed for actual production. Actual price and standard price for standard quantity allowed for units actually produced. The usage variances focus on the difference between.

VARIANCES SALES The difference between a budgeted profit and the actual profit achieved in a period is explained by. The variance is used in a standard costing system usually in conjunction with the purchase price variance. Actual quantity used and standard quantity allowed for estimated activity.

Revenue centers could look at both the flexible budget variance and the sales volume variance. Actual quantity used and standard quantity allowed for actual production. None of the above.

The direct material usage variance is the difference between the actual and expected unit quantity needed to manufacture a product. The quantity difference is multiplied by a standard price to provide a monetary measure that can be. Both a and b.

Cactual quantity used and standard quantity allowed for actual production. Sometimes that can mean changing the land use entirely and other times it can mean asking for an exception to a relatively minor. A usage variance is the difference between the expected number of units used in a process and the actual number used.

A price variance reflects the difference between what was paid for inputs and what should have been paid for inputs. Actual costs of inputs and standard costs of inputs. Actual costs of inputs and standard costs of inputs.

Efficiency variance is a numerical figure that represents the difference between the theoretical amount of inputs required to produce a unit. If fewer units are used than expected the difference is considered a favorable variance. Actual costs of inputs and standard costs of inputs.

Actual price and standard price for actual quantity for estimated activity. Actual quantity used and standard quantity allowed for actual production. Price variances focus on the difference between.

Actual quantity used and standard quantity allowed for budgeted production. Bactual quantity used and standard quantity allowed for budgeted production. Rezoning conditional use permits and zoning variances come into play when someone a real estate developer a business owner or a homeowner wants to do something that is different from what the zoning laws allow.

If more units are used than expected the difference is considered an unfavorable variance. None of the above. Management by ception is a tehen used in performance evaluation Describe management by exception and how it is used in the w on of con ando con Performance reports for cost revenue and profit centers by Its attention on important dirences between Using management by exception management only in wances since the cost variances and or.

Actual quantity used and standard quantity allowed for units actually produced. The usage variances focus on the difference between a. The usage variances focus on the difference between.

The usage variances focus on the difference between a. View Standard Costing Slides Week 2pdf from ACC 2011S at University of Cape Town. 1 Efficiency variances focus on the difference between a actual quantity used and standard quantity allowed for estimated activity b actual quantity used and standard quantity allowed for.

Both a and b. These variances are useful for identifying and correcting anomalies in the production and procurement systems. Quantity allowed for estimated production and standard quantity allowed for units actually produced.

Actual quantity used and standard quantity allowed for budgeted production. Profit centers are responsible for both generating revenue and controlling costs so profit center managers would review variances for revenues and costs. For cost centers management would focus on the difference between the actual results and the flexible budget.

Direct Materials Variance Analysis Accounting For Managers

Planning Operational Variances By Management Accounting Issuu

Describe How Companies Use Variance Analysis Principles Of Accounting Volume 2 Managerial Accounting

Comments

Post a Comment